Providing strategic allocations of private alternative investments not dependent on the performance of the stock market

Be sure to visit our latest INSIGHTS blog post…

“PRIVATE CREDIT—

A VITAL ASSET CLASS FOR TODAY’S INVESTORS”

PART 3 – Time-Tested Resilience

Well-Established Firm

TRO Investment Group has been operating successful alternative investment funds since 2005. Our most recent offering is TRO Specialty Private Credit Fund, LLC.

Focused on Private Investments with Strong Risk-Adjusted Returns

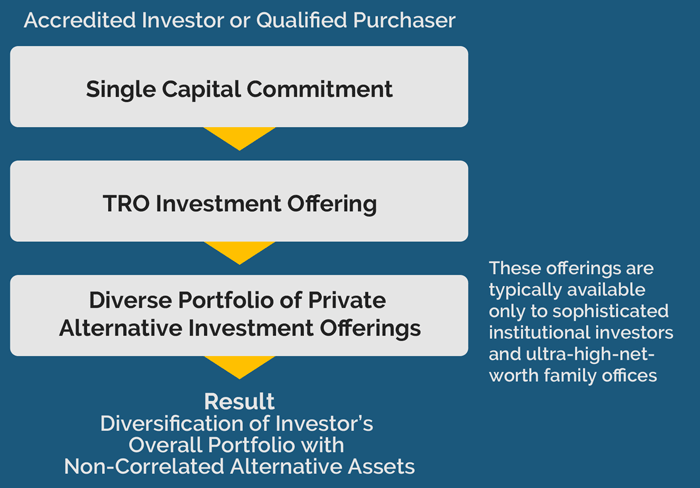

The Firm invests in a diversified range of well-managed private alternative investment funds and partnerships that offer strong total return, formidable downside protection and minimal correlation to the stock market, and are generally not accessible to individual investors.

Investor Profile: Seeking Independence from the Stock Market

Individual Accredited Investors and Qualified Purchasers who want to diversify their taxable investment portfolio or their retirement accounts to reduce dependence on the stock market while maintaining attractive returns.

Experienced Management Team

TRO Investment Group is led by Richard A. Lund, Founder and Managing Member, and Jeffrey A. Wellek, Partner. Both Mr. Lund and Mr. Wellek have over thirty-five years of industry experience.

ACCESS TO PRIVATE ALTERNATIVE ASSETS

We help our investors do what many of the nation’s wealthiest and most sophisticated investors do to achieve strong total returns without overly relying on the stock and bond markets: Our funds enable an individual investor to gain access to a diversified portfolio of privately managed alternative assets with a single capital commitment.

OUR CURRENT FOCUS:

PRIVATE CREDIT AND SPECIALTY FINANCE

What’s New…

While TRO has historically invested in two categories of assets—1. real estate, and 2. a range of private credit investments—we are currently focusing on the credit category. In this way, we can better meet the growing investor demand for dedicated investments in this compelling asset class.

What’s the Same…

We continue to build our portfolios with select alternative assets that produce substantial income flow, have appreciation potential, feature inherent safeguards and are largely uncorrelated to the stock and bond markets.

PRIVATE CREDIT

Senior Direct Lending…With an Edge

Private credit capitalizes on American businesses’ critical need for non-bank credit financing.

TRO invests with non-bank lenders who originate senior (first lien) business loans with attractive coupons.

We seek advantageous credit niches such as underserved markets, esoteric industries, value-add lending, the credit secondary market, etc.

SPECIALTY FINANCE

Niche Enhanced-Return Strategies

TRO also invests in the closely related sub-asset class of specialty finance.

Our specialty finance investment sponsors practice an extensive variety of opportunistic niche disciplines based on credit obligations that they originate or acquire.

We seek to identify specialty finance investment disciplines that have the potential to earn elevated returns.

In the combined portfolio, our goal is to generate equity-like returns without equity-like risk; i.e., free from any direct involvement in the public stock market.

BEST-IN-CLASS SPONSORS

We invest only in offerings managed by select, talented asset managers who satisfy these minimum prerequisites:

- Successful track record in their field of specialization.

- Proven ability to add value through upgrading, renegotiation, etc.

- Substantial alignment of interest with investors.

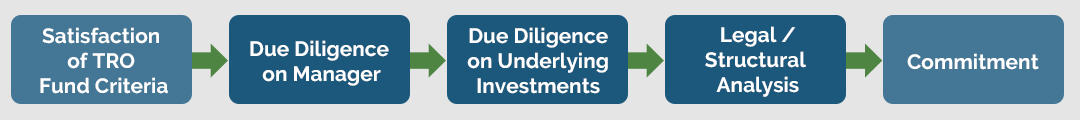

EXTENSIVE DUE DILIGENCE

We use a stringent due diligence process to thoroughly vet the managers we are considering for investment, as well as their underlying investment offerings and terms.

EXPERIENCED MANAGEMENT TEAM

Richard A. Lund | Founder & Managing Member

35+ Years of Experience

in the financial services industry as an asset manager, risk manager, exchange committee member and business executive.

Extensive Network

for finding niche investments and unique opportunities not typically accessible to individual investors.

Strong Alignment of Interests

with investors, achieved by investing significant personal capital alongside investors in TRO investment offerings.

MORE ABOUT RICHARD LUND...

INVESTMENT FUNDS

Richard Lund has directed the investment strategy for a number of alternative funds:

- TRO Investments, LLC (2005)

- TRO Investments II, LLC (2006)

- LSM Investments, LLC (2007)

- TRO Azure Cap III, LLC (2011)

- TRO Investment Partners, LLC (2011)

- TRO Investment Partners II, LLC (2017)

- TRO Investment Partners III, LLC (2019)

- TRO Investment Partners IV, LLC (2021)

- TRO Specialty Private Credit Fund, LLC (2025)

With his earliest offering, TRO Investments, LLC (2005), Mr. Lund created the first fund enabling outside investors to invest in seats on the Chicago Board Options Exchange (CBOE). Participants in the fund earned a 4x multiple on their investment. In connection with this enterprise, he served on several key CBOE committees and played an influential role in the Exchange’s move towards going public in 2010. Spurred by the success of his early funds, Mr. Lund launched the first of the TRO Investment Partners offerings in 2011, with many of the same investors participating.

PRIOR INDUSTRY EXPERIENCE

Earlier in his career, Mr. Lund was the co-founder and managing member of Triangle Trading LLC, a market-making firm in equity options on the CBOE floor. Prior to that, he founded and served as president of RL Trading Corp., an “upstairs” volatility arbitrage firm. He was also a senior trading executive at Swiss Bank Corp-O’Connor and Associates, serving in London as business head/senior risk manager in the European time zone for the Asian equity derivatives group and later in Chicago, also as business head/senior risk manager, for the Latin American equity derivatives group.

EDUCATION

Mr. Lund graduated from Indiana University in 1987 with a Bachelor of Science degree in Finance.

Jeffrey A. Wellek | Partner, TRO Investment Group

Jeffrey Wellek uses his three decades of financial, corporate and legal experience to assist in sourcing, structuring and performing due diligence on the Fund’s investments.

MORE ABOUT JEFFREY WELLEK...

Jeffrey Wellek has over 35 years of multi-disciplinary experience in private equity investing, corporate acquisitions, manufacturing operations, law and accounting.

- Mr. Wellek formally joined TRO in 2017 after being an advisor and investor in the prior TRO funds.

- He founded NJB Investments, LLC in 2009 and co-founded Focus Investments, Inc. (“FII”) in 2001.

- FII formed Focus Products Group (“FPG”) and it acquired 15 companies over a 6-year period increasing annual sales from $20 million to over $200 million in the hospitality, foodservice and consumer markets. In 2006, FII sold the majority interest in FPG generating a 10x return for investors.

- In 2011, FII acquired O2Cool, LLC, a leading designer and distributor of innovative products targeting the outdoor enthusiast and active lifestyle markets and successfully sold O2Cool in 2017 generating a 4x return for investors.

- Prior to Focus, Mr. Wellek was a founding partner of Dakota Capital Partners, LLC, a private equity investment firm responsible for investing in six platform portfolio companies and eight add-on acquisitions and worked at the equity investment division of Heller Financial, Inc.

- Mr. Wellek began his career as an attorney specializing in mergers and acquisitions and securities law with what is now Katten Muchin Rosenman LLP, an international law firm based in Chicago.

- He currently sits on the board of directors of a number of private businesses and is also active in several philanthropic organizations.

- Jeff received a BS in Accountancy from the University of Illinois and a JD from Northwestern University. He is licensed to practice law in the State of Illinois and is a CPA.

TRO Advisory Board

The Management Team works with an Advisory Board comprised of seven members with deeply rooted investment experience and significant commitments in the Fund.

ABOUT THE ADVISORY BOARD...

The Advisory Board members will assist in a number of critical areas:

- Sourcing deal flow

- Facilitating investment introduction

- Providing strategic business guidance

ADVISORY BOARD MEMBERS

Dan Drexler – Director of Research at Longview Asset Management, a multi-strategy investment vehicle for the Crown family of Chicago.

John Eanes – Co-Chief Executive Officer and head of liquid investments at Irradiant Partners, LP. Prior to the launch of Irradiant Partners, John served as head of the liquid credit group at Kayne Anderson Capital Advisors.

David J. Friedman – President of Conor Commercial Real Estate, a national industrial and multifamily development company that serves as the development entity of The McShane Companies. Prior to Conor, David held executive positions at Ares Management, Sterling Partners and Heller Financial.

Scott Goodman – Founding Principal of Farpoint Development, where he focuses on acquisitions, investor relations, procurement of financing and equity, and transaction structuring.

Alan D. Lev – President/CEO of Belgravia Group, Ltd., a Chicago residential homebuilder that was most recently awarded Developer of the Year from Chicago Agent Magazine. Alan joined Belgravia Group in 1989. He is also an attorney, a CPA, a licensed real estate broker, and a licensed insurance broker.

John Petrovski – A former banker, who during his career served as Group President for three different real estate lending/investing programs—at Heller Financial, Merrill Lynch Capital and BMO Harris Bank—each program consisting of 80-150 teammates and originating 150+ transactions ($3 billion) per year.

Carol Roth – Internationally recognized business expert, former investment banker, investor, the entrepreneur behind the Future File® legacy planning system, and the author of The New York Times bestselling book, The Entrepreneur Equation. Carol is also a media contributor to outlets ranging from CNBC to MSNBC to Fox Business.

TRO INSIGHTS

TRO INSIGHTS

Read our latest post…

“PRIVATE CREDIT—A VITAL ASSET CLASS FOR TODAY’S INVESTORS (Part 3)”

CONTACT

TRO Investment Group

TRO Investment Group

666 Dundee Road

Suite 1804

Northbrook, Illinois 60062

Richard Lund, Manager

richard.lund@troinv.com

224.723.5688