Richard A. Lund

Founder & Managing Member

TRO Investment Group

Author

Richard A. Lund

Founder & Managing Member

TRO Investment Group

- Private Credit’s Multi-Faceted Investment Potential

- Its Important Role in Commerce

- Its Time-Tested Resilience

In that post, we focused on criteria number one. In this post, we’ll delve into our second criteria…

Criteria #2: Private Credit’s Important Role in Commerce

Private credit has become a key provider of finance capital for a broad swath of American businesses and plays a critical, growing role in the nation’s commerce and economy

When early forms of private credit investing first appeared in the 1980s and 1990s, it was a niche market for certain types of institutional investors. Its transformation into an important widescale provider of business capital was sparked by the banking regulations promulgated in the aftermath of the 2008 Global Financial Crisis. These regulations were aimed at restricting certain types of bank lending practices that had led to the crisis.

These restrictions significantly limited the ability and flexibility of banks in making loans. As a result, many American businesses—particularly those in the so-called middle market (annual revenue from $10 million to $1 billion)—lost access to their traditional providers of loan financing. This led middle market companies to turn to the private credit market to meet their needs for working and growth capital.

PERCENTAGE OF MIDDLE MARKET LOANS ISSUED BY BANKS

Sources: FDIC.gov; Fed. Notes

Over the years since then, American companies seeking debt capital have been increasingly turning to private lenders for a number of compelling reasons:

- Access As the average transaction size has grown in the bond and syndicated loan markets, mid-size companies have found it increasingly difficult to access capital in those public markets.

- Certainty / Speed Private credit financing typically involves a single lender, which is why the private credit route generally offers greater certainty and speed of execution than attainable in the public markets, as well as a higher degree of confidentiality.

- Flexibility Private lenders are able to evaluate assets and structures that are too complex for traditional underwriting and they have the flexibility to accommodate a borrower’s changing financial situation in difficult economic environments.

As more and more companies have been resorting to private lenders, growing numbers of investment sponsors have ventured into the lending space to form private credit funds.

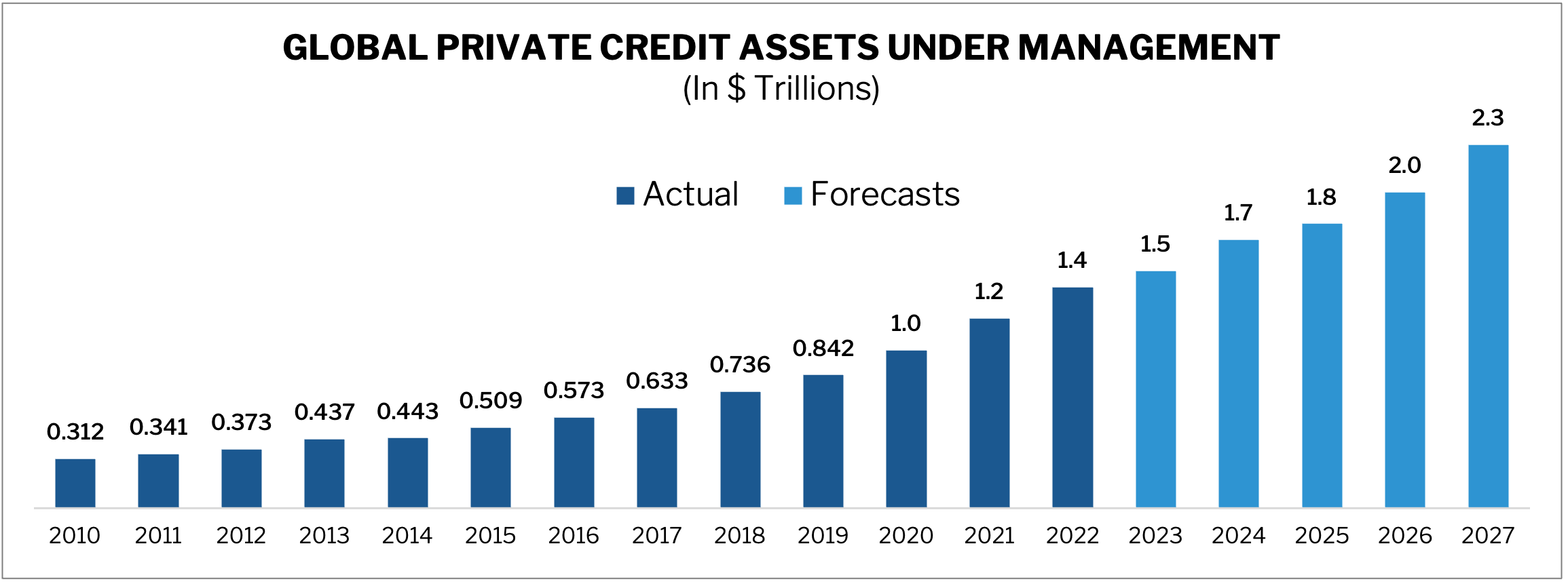

An asset class that has grown exponentially

From a small institutional niche, private credit has grown into a $1.5 trillion asset class over the past dozen years or so.

Source: Bloomberg (as reported by Preqin)

By the end of 2023, global private credit AUM is projected to surpass $1.5 trillion—triple its value in 2015—and then to grow by an additional 50% over the next four years to $2.3 trillion.

Serving a huge vibrant market, critical to U.S. growth

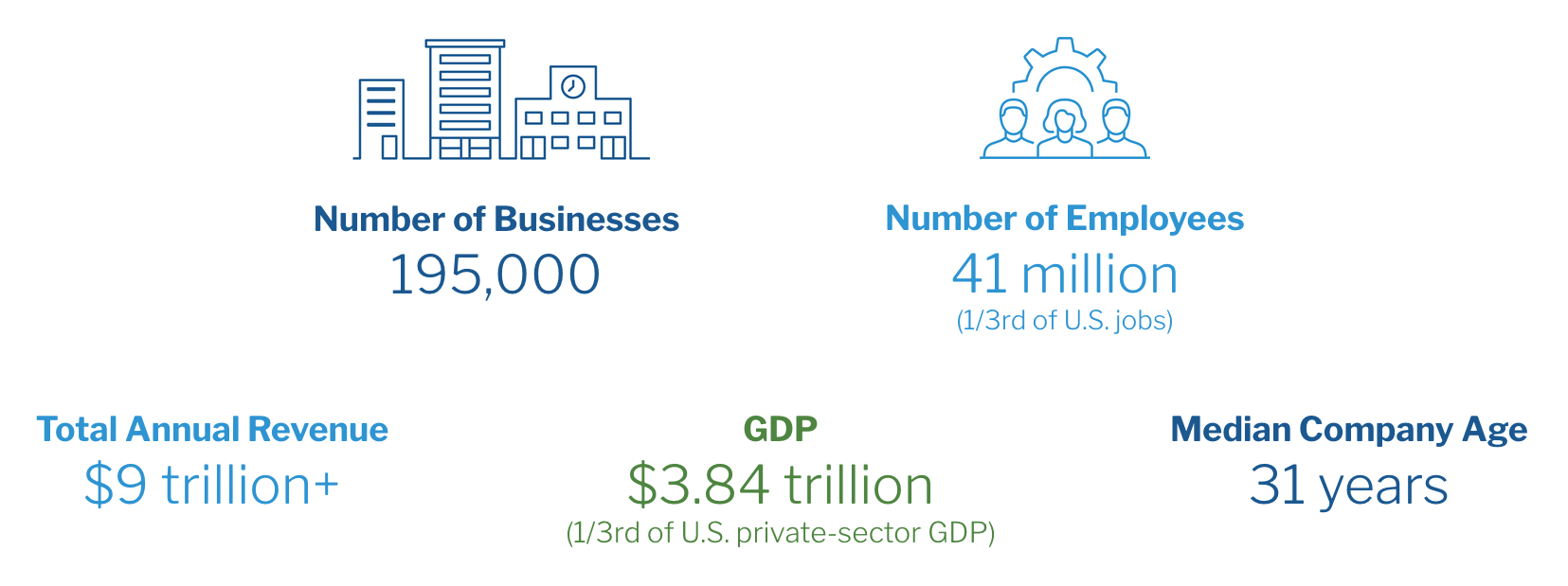

It may surprise many people just how vital—and large—America’s middle market actually is.

The U.S. middle market sits between small businesses (annual revenues under $10 million) and the large multinational corporations (annual revenues greater than $1 billion). According to the National Center for the Middle Market, the middle market exerts an influence on the national economy that is as large and important as that of those other two segments of American commerce. To put this in perspective…

If the middle market were a country, it would rank as the fourth largest economy in the world in terms of GDP—just behind Japan, and ahead of Germany.

The almost-200,000 businesses that constitute the middle market span many industry sectors and U.S. regions, and they include enterprises that are publicly traded corporations, privately owned companies (including many family owned), partnerships and sole-proprietorships. What’s more, they are America’s most sustainable source of jobs and revenues. These numbers tell the story…

THE U.S. MIDDLE MARKET

A Key Driving Force of the U.S. Economy

Number of Businesses

195,000

Number of Employees

41 million

(1/3rd of U.S. jobs)

Total Annual Revenue

$9 trillion+

GDP

$3.84 trillion

(1/3rd of U.S. private-sector GDP)

Median Company Age

31 years

Source: National Center for the Middle Market

Key Take-Aways

Private Credit’s Important Commercial Role

In addition to being a high-performance asset class for investors, private credit plays an important role in the nation’s commerce and economy…

- A rapidly growing source of financing for American businesses—particularly those in the middle market, which produces 1/3 of U.S. private-sector GDP.

- Global private credit AUM projected to surpass $1.5 trillion by year-end 2023—triple its value in 2015—and then grow by an additional 50% over the next 4 years to $2.3 trillion.

Author’s Viewpoint

At TRO Investment Group, we focus on long-term investment fundamentals. Accordingly, we favor asset classes with a high degree of commercial utility—those that serve an important function in commerce, finance, or both—rather than the latest hot financial products or speculative fads.

As the facts show, private credit fits our criteria well.

In an upcoming Insights post, we’ll highlight our third key criteria for favoring private credit—its time-tested resilience. So, once again, please stay tuned.

Performance expectations are subject to future adjustment and revision. The information provided is historical and is not a guide to future performance. Past performance is not necessarily indicative of future results. Any decision to invest must be based solely upon the information set forth in offering documents furnished by TRO Investment Group regardless of any information investors may have been otherwise furnished. This is neither an offer nor solicitation for the sale of a security.